Request A Call Back

Register Real Account

Register Demo Account

📈Latest NFP (US Non-Farm Payroll) Data Prediction for the Month of AUGUST 2022

By XFlow Markets Team Friday, Sep 2, 2022 | World News

US Non-Farm Payroll Data Forecast

On contrary, the probability of rate hike in upcoming ECB meeting remains bearish factor for USD.

Besides this, the commodities are ranging on lower levels amid slowdown in consumption demand & poor Chinese economic conditions.

The market will be monitoring an outcome of U.S Non-farm payroll which to be issued on September 02, 6.00pm IST, Friday & will show a change in the number of employed people during the previous month, i.e. August, excluding the farming industry.

The report expects a drop-down in employment figure by 295K lower than previous reading of 528K while Unemployment Rate may remain steady at 3.5%.

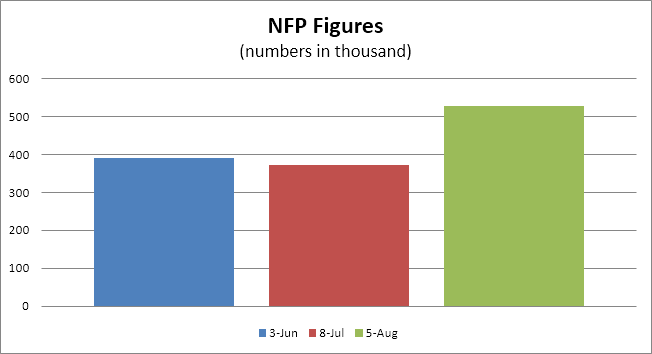

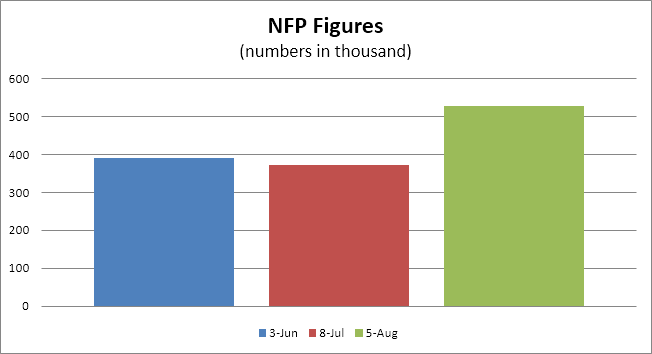

Above graph shows mild progress in employment sector in last three months; however the recent forecast may drag down the curve.

On Wednesday, the result of ADP Employment Change data showed a fall in number by 132K lower than expectation which raises the chances of poor outcome of today’s NFP estimates.

If NFP data comes out to be stronger, then the possible effect can be – strong US Dollar Index, soft precious metals & stronger global indices. Other way round, if data shows downbeat results, then downside in indices & buying bias in Gold can be noticed.

| Prepare yourself for NFP release on |

| September 2. 2022. at 6.00pm IST, Friday |

XFlow Markets Team

XFlow Markets is one of the leading brokerage firm in the trading industry with vast number of clientele followers. We are ranked as the top most firm with 9 years of experience along with top-notch trading services. We widely trade in Forex, Indices, and Commodities.

Related News & Updates

Federal Reserve Set for Potential Rate Cut; Market Awaits Key Insights from Updated Projections and Powell’s Remarks

The Federal Reserve is expected to lower the policy rate after its September meeting, but the size of the cut remains uncertain. Along with the rate decision, the Fed will Continue reading

**Critical Jobs Data in Focus: NFP Report to Shape Fed’s Next Moves Amid Slowing Labor Market**

Today’s Non-Farm Payrolls (NFP) report, set to be released on September 6, 2024, is expected to play a pivotal role in determining the Federal Reserve’s next moves on interest rates. Continue reading

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)