Request A Call Back

Register Real Account

Register Demo Account

Global Sentiments Improved Over Less Hawkish Fed Stance While Oil Rallied to 10-weeks Highs

By Research Team Friday, Jul 14, 2023

- 9.00amd1

- High1.12429

- Low1.12132

- Close1.12348

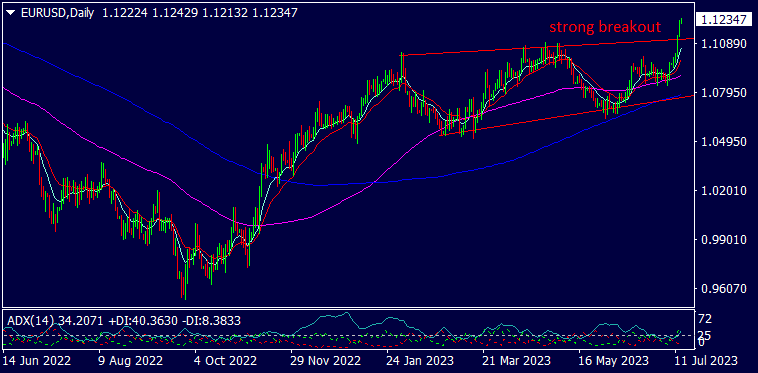

EUR/USD is trading at 1.12352, 0.31% up since previous day close. A sharp spike can be seen in EURO since last two sessions amid soft USD on account of softer-than-expected U.S CPI rate change issued on Wednesday; which may restrict the chances of aggressive interest rate hike by Fed in this year. On contrary, the ECB maintains its hawkish monetary stance over future course of time which makes the EURO to trade on higher side. The result of Trade Balance data will remain in focus for the day. As seen in the chart, the pair successfully crossed over the long-term Moving Average of period which shows the buying bias at each & every corrective dip on an intraday basis.

Read More… Read LessDaily Outlook

EUR/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.13946 |

| R2 | 1.12944 |

| R1 | 1.12589 |

| Turnaround | 1.11942 |

| S1 | 1.11587 |

| S2 | 1.10940 |

| S3 | 1.09938 |

By Research Team Friday, Jul 14, 2023

- 9.17amd1

- High

- Low

- Close

UK100 is trading at 7424, 0.19% up since previous day close. The U.K index saw an upward momentum in the previous session as global sentiments turned positive. Majorly, the U.S CPI rate grew by just 0.2% lower than expectation 0.3% which gave a sigh of relief amongst the traders as this may reduce the aggressive rate hike stance in Fed’s meeting. This widely cushioned the major indices. In U.K, the GDP fell by 0.1% lower than expected fall of 0.3% while the NIESR GDP Estimate showed no major change in the result. As seen in the chart, the UK100 formed a double bottom at 7200 levels & acted as a major support level as well. The index reversed upside & has approached MA (100). Further buying may be recommended for the day in UK100.

Read More… Read LessDaily Outlook

UK100

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 7531.00000 |

| R2 | 7481.00000 |

| R1 | 7458.00000 |

| Turnaround | 7431.00000 |

| S1 | 7408.00000 |

| S2 | 7381.00000 |

| S3 | 7331.00000 |

By Research Team Friday, Jul 14, 2023

- 9.38amd1

- High77.28

- Low76.89

- Close76.91

WTI Oil is trading at $76.94, 0.31% up since previous day close. The Oil prices tested 10-weeks high on Thursday amid supply disruptions from Libya & Nigeria; two major Oil producing countries. Globally, the softer than expected U.S CPI data which signaled for a progressive control over inflationary pressure in U.S may retain the Oil demand & hence, pushed up the prices. The chances of stimulus package offering to Beijing may further support the prices since China is a top consuming country of Oil. The result of U.S Baker Hughes report will remain in focus for the day. Buying bias may be recommended for the day since the commodity successfully crossed over MA (200).

Read More… Read LessDaily Outlook

OIL

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 80.68000 |

| R2 | 78.65000 |

| R1 | 77.94000 |

| Turnaround | 76.62000 |

| S1 | 75.91000 |

| S2 | 74.59000 |

| S3 | 72.56000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)