Request A Call Back

Register Real Account

Register Demo Account

Market Ahead of U.S Jackson Hole Speech While Indices Trades in a Tight Range

By Research Team Tuesday, Aug 22, 2023

- 9.35amd1

- High1.27778

- Low1.27558

- Close1.277

GBP/USD is trading at 1.27744, 0.16% up since previous day close. The Sterling Pound showed an upside against the mixed USD ahead of the FOMC Powell speech at Jackson Hole Symposium later in this week. The major currencies showed a slight depreciation earlier after PBoC cut-down its prime rates lower than expectation; weakening the market sentiments. Uncertain U.S Fed monetary stance will remain vital for Pound. The U.K Rightmove HPI fell by 1.9% versus -0.2% in the prior month while the result of Public Sector Net Borrowing data will remain in to focus today. As seen in the chart, the pair crossed over short-term MA (10) & MA (20) which indicates the buying bias on lower side for the day.

Read More… Read LessDaily Outlook

GBP/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.28585 |

| R2 | 1.28020 |

| R1 | 1.27808 |

| Turnaround | 1.27455 |

| S1 | 1.27243 |

| S2 | 1.26890 |

| S3 | 1.26890 |

By Research Team Tuesday, Aug 22, 2023

- 9.56amd1

- High14983

- Low14943

- Close14963

US100 is trading at 14970.3, 0.18% up since previous close. The mild recovery can be seen in US100 on Tuesday as traders waits for the U.S Powell speech at Jackson Hole Symposium which is to be held later in this week. On Monday, the Chinese PBoC cut-down its Prime Lending Rate lower than expectation which signals slowdown in economic growth & weakened the sentiments amongst the traders & investors. Last week, the U.S FOMC Minutes hinted for higher rate hikes in the near future & so that, the higher rates might remain for longer period of time which subdued the markets. As seen in the chart, the index seems to be taking a support of MA (100) which acts as a major support level. Slight buying bias may be initiated for the day in US100.

Read More… Read LessDaily Outlook

US100

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 15481.00000 |

| R2 | 15188.00000 |

| R1 | 15071.00000 |

| Turnaround | 14895.00000 |

| S1 | 14778.00000 |

| S2 | 14602.00000 |

| S3 | 14309.00000 |

By Research Team Tuesday, Aug 22, 2023

- 10.18amd1

- High1897.29

- Low1893.64

- Close1895.3

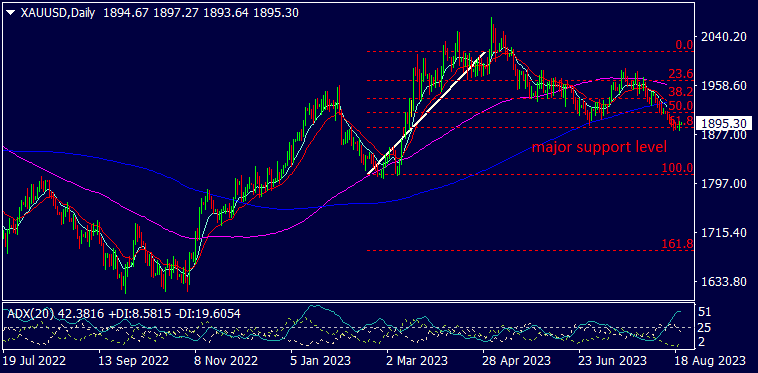

Gold is trading at $1895.82, 0.03% up since previous close. The Gold seems to be trading flat to higher side since last two sessions against the steady USD ahead of the U.S Jackson Hole Symposium speech which is to be held later in this week. Earlier, the China cut-down its Prime Lending Rate lower-than expectation which weakened the market sentiments & hence, subdued the gold prices; for China is a major consumer of metals. Last week, the U.S FOMC Minutes showed the chances of higher interest rates in the future course of time in order to control the rising inflation rate which contributed bearishness in prices. Slight buying may be established in Gold since the commodity is expected to take a support of Fibo level 61.8.

Read More… Read LessDaily Outlook

GOLD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1920.67000 |

| R2 | 1906.72000 |

| R1 | 1900.72000 |

| Turnaround | 1892.77000 |

| S1 | 1886.77000 |

| S2 | 1878.82000 |

| S3 | 1864.87000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)