Request A Call Back

Register Real Account

Register Demo Account

Steady Gold, Cautious Pound, and Trepidatious Stocks: Market Pulse Check!

By Research Team Friday, Mar 1, 2024

- 10:50 AMD1

- High1.26352

- Low1.26232

- Close1.26250

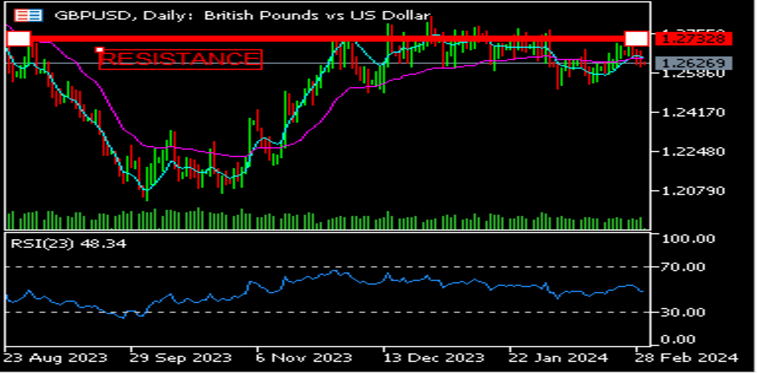

USD/CAD is trading at 1.26269, 0.03% up since previous day close. The GBP/USD pair has slightly recovered from a one-week low, with some buying during the Asian session. Bets that the Fed won’t cut rates before the June policy meeting should limit USD losses. Traders are now focusing on the US ISM PMI and Consumer Sentiment Index for fresh impetus. The PCE Price Index showed annual inflation in January was the lowest in three years, reaffirming bets for an eventual rate cut. As seen in the chart, the pair is still hovering around the resistance area, since days, hence, a rejection is expected.

Read More… Read LessDaily Outlook

GBP/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.2736 |

| R2 | 1.2697 |

| R1 | 1.2666 |

| Turnaround | 1.2640 |

| S1 | 1.2620 |

| S2 | 1.2597 |

| S3 | 1.2528 |

By Research Team Friday, Mar 1, 2024

- 11:02 AMD1

- High39086

- Low39005

- Close39064

US30 is trading at 39060.5, 0.03% up since previous day close. US stock futures fell after strong gains during the session, with signs of cooling inflation boosting optimism over falling interest rates in 2024. The PCE price index data eased slightly in January, leading some bets that the Fed will begin cutting rates by June. However, inflation remained well above the Fed’s 2% annual target, raising doubts over the timing of the central bank’s potential cuts. As seen in the chart, the index is in an upside rally, hence a bullish moment is expected today.

Read More… Read LessDaily Outlook

US30

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 39157.59 |

| R2 | 39103.01 |

| R1 | 39035.75 |

| Turnaround | 38981.17 |

| S1 | 38913.91 |

| S2 | 38905.87 |

| S3 | 38859.33 |

By Research Team Friday, Mar 1, 2024

- 11:25AMD1

- High2046.84

- Low2042.85

- Close2044.81

XAU/USD is trading at 2045.15, 0.04% up since previous day close. Gold price (XAU/USD) is supported by bets for an imminent Fed rate cut later this year, with the risk-on environment limiting further gains. The US Personal Consumption Expenditures Price Index shows annual inflation was the lowest in three years, opening the door for an interest rate cut. The hawkish outlook supports elevated US Treasury bond yields, which could limit USD downside and cap the upside for the non-yielding Gold price. As seen in the chart, gold has been moving towards resistance, hence a breakout is expected, if breaches the level.

Read More… Read LessDaily Outlook

XAU/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 2060 |

| R2 | 2051.5 |

| R1 | 2047.44 |

| Turnaround | 2037.6 |

| S1 | 2030 |

| S2 | 2024 |

| S3 | 2019 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)