Request A Call Back

Register Real Account

Register Demo Account

Daily Outlook

USD/JPY, GER30, & GOLD

USD/JPY is trading at 149.86, 0.15% up since previous day close. BoJ have resulted in the Japanese Yen strengthening. According to the Ministry of Finance in Japan, ¥5.5 Continue reading

GER30 is trading at 18455, 0.35% down since previous day close. A global rally sparked by the U.S. Federal Reserve's hint that it may ease in September was halted on, the Continue reading

XAU/USD is trading at 2447, 0.19% up since previous day close. On Thursday, gold (XAU/USD) traded near a two-week high achieved during the Asian session, moving between m Continue reading

EUR/USD, US 100 and Silver

EUR/USD is trading at 1.0824, 0.10% up since previous day close. Ahead of Eurozone inflation statistics, EUR/USD continues to rise beyond 1.0800. Both the Fed and the ECB Continue reading

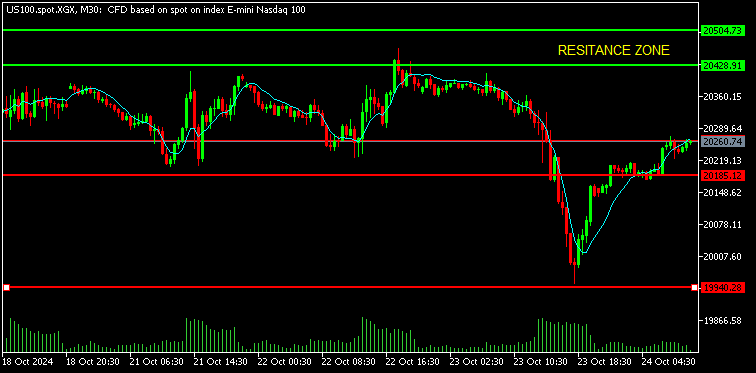

US 100 is trading at 19052, 1.75% up since previous day close. As megacaps and chips decline ahead of Big Tech results, nasdaq plummets. Expectations that the Federal Res Continue reading

SILVER is trading at 28.58, 0.68 up since previous day close. During the Asian session on Wednesday, silver rises for the second day in a row and reaches a multiday high. Continue reading

USD/JPY, US 100 and Gold

USD/JPY is trading at 155.06, 0.37% up since previous day close. In the Asian session on Tuesday, the USD/JPY has gained momentum to reach 154.00. As the US Dollar benefi Continue reading

GER30 is trading at 18378, 0.18% up since previous day close. Tuesday's opening of European equities was positive due to advances in oil and technology sectors, but inves Continue reading

XAU/USD is trading at 2390, 0.19% up since previous day close. With several forthcoming high-high macro news events from the US and Europe, the price of gold is hovering Continue reading

GBP/USD, US 100, WTI

GBP/USD is trading at 1.2819, 0.06% up since previous day close. In the early hours of European trading on Monday, the GBP/USD pair trades at 1.2875, on the stronger side Continue reading

US 100 is trading at 19137, 0.73% up since previous day close. The little increase in US prices highlighted a strengthening inflationary environment, which may set the Continue reading

WTI is trading at 77.88, 1.30% up since previous day close. Rising geopolitical concerns in the Middle East and the potential for OPEC to postpone the anticipated reducti Continue reading

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)