Request A Call Back

Register Real Account

Register Demo Account

Daily Outlook

USD/JPY, GER 30, WTI

USD/JPY is trading at 158.47, 0.31% up since the previous day's close. Tuesday's trading in Asia is seeing the USD/JPY continue to rise beyond 158.50. The Japanese Yen is Continue reading

GER30 is trading at 18514, 0.33% down since the previous day's close. At the end of the previous day, German stocks had dropped due to losses in the DAX Construction, DAX Continue reading

WTI is trading at 81.16, 1.00% down since the previous day's close. US crude oil, West Texas Intermediate Around the mid-$80.00s, or a multi-day low reached during the Continue reading

EUR/USD, US30, & SILVER

EUR/USD is trading at 1.0898,0.07% down since previous day close. During Monday's Asian session, EUR/USD is under attack below 1.0900. Due to risk aversion following the Continue reading

US30 is trading at 40149,0.31% up since previous day close. In the twilight hours of Sunday, U.S. market index futures remained stable amidst conjecture on the potentia Continue reading

XAG/USD is trading at 30.68, 0.27% down since previous day close. In a placid market response to conflicting economic data in China's largest consumer nation, silver held Continue reading

EUR/USD, US30, & GOLD

EUR/USD is trading at 1.0873, 0.05% up since previous day close. During 1.0850 in the early European session on Friday, the EUR/USD pair consolidates its weekly gains. Continue reading

GER30 is trading at 18549, 0.15% up since previous day close. Germany's stock market closed higher, with the DAX up 0.72%. Following the closing on Thursday, Germany's st Continue reading

XAU/USD is trading at 2404,0.45% down since previous day close. The US Producer Price Index data and the potential for further Japanese intervention in the FX market are Continue reading

GBP/USD, US100, & WTI

GBP/USD is trading at 1.2877,0.15% up since previous day close. During 1.2850 in the European morning on Thursday, the GBP/USD pair maintains modest advances. Despite per Continue reading

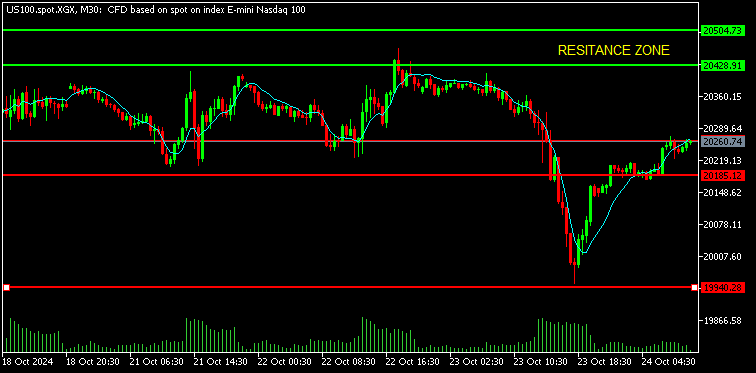

US100 is trading at 20659,0.04 down since previous day close. Important inflation statistics and speeches by Federal Reserve Chair Jerome Powell are anticipated to provid Continue reading

WTI is trading at 82.30,0.26 % down since previous day close. On Thursday, oil prices increased as gasoline inventories decreased, indicating increased demand, and as c Continue reading

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)