Request A Call Back

Register Real Account

Register Demo Account

Daily Outlook

USD/JPY, US100 & WTI

USD/JPY is trading at 161.68, 0.13% up since previous day close. Suggesting upward momentum, according to the analysis of the daily chart, which indicates a bullish bias. Continue reading

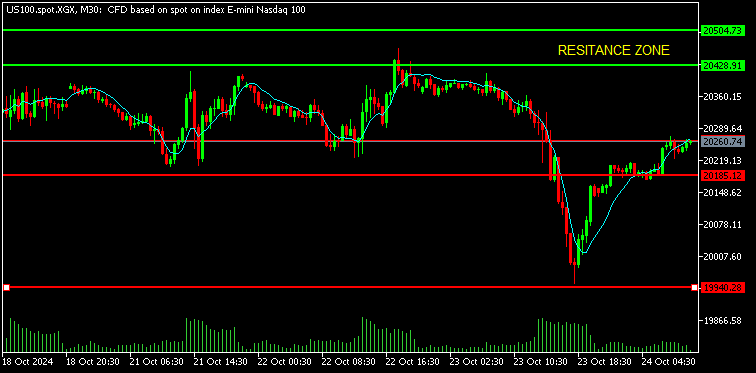

US100 is trading at 19761, 0.08% down since previous day close. Ahead of a slew of economic data this week that could provide hints about the possibility of a FED interes Continue reading

WTI is trading at 83.72, 0.17% up since previous day close. Tuesday's oil prices barely moved, remaining close to the two-month highs hit during the previous session due Continue reading

EUR/USD, US100, & GOLD

EUR/USD is trading at 1.0693, 0.13% up since previous day close. The pair gains support from the resumption of US Dollar selling combined with the decline in the USD/JPY. Continue reading

US100 is trading at 19700, 0.03% up since the previous day's close. After brutal selloffs, Nvidia and other AI-related stocks saw a rise on Tuesday, and investors anticip Continue reading

XAUUSD is trading at 2299.86, 0.02%, down since previous day close. XAUUSD remains close to two-week lows, failing to show any signs of a significant rebound as it traded Continue reading

USD/JPY, US100, WTI

USD/JPY is trading at 159.80, 0.13% up since the previous day's close. The upside for the major is capped by worries that the government will step in to support the Japan Continue reading

US100 is trading at 19800, 0.37% up since the previous day's close. After brutal selloffs, Nvidia and other AI-related stocks saw a rise on Tuesday, and investors anticip Continue reading

WTI is trading at 81.56, 0.58% up since previous day close. Following a 1% decline in the previous session due to a strengthening US dollar and poor consumer confidence d Continue reading

EUR/USD, GER30, SILVER

EUR/USD is trading at 1.0736, 0.01% up since previous day close. As traders in Europe realign themselves in anticipation of Sunday's French election, risk flows persist a Continue reading

GER30 is trading at 18190, 0.16% down since previous day close. Tuesday saw a 1.1% drop in the DAX to the 18125 mark, erasing the previous session's gains and following i Continue reading

SILVER is trading at 29.50, 0.06% down since previous day close. On Tuesday, silver prices (XAG/USD) increased. As the XAG/USD pair consolidates within the descending cha Continue reading

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)