Request A Call Back

Register Real Account

Register Demo Account

Daily Outlook

USD/CAD, XAUUSD (Gold) & CHNIND

USD/CAD is trading at 1.36317, 0.06% up since previous day close. The flat trading can be seen in Canadian Dollar amid mixed global sentiments over suspicious chances of Continue reading

CHNIND is trading at 6098.3, 0.04% down since previous close. The mixed trading can be seen in Chinese stocks ahead of the release of key economic data due on Wednesday. Continue reading

Gold is trading at $1915.44, 0.16% up since previous close. The flat to higher side trading can be seen in safe-haven gold against the mixed USD on account of uncertain c Continue reading

USD/JPY, US30 & WTI Oil

USD/JPY is trading at 149.338, 0.02% up since previous day close. The tight range can be observed in USD/JPY against the steady USD amid uncertain chances over interest r Continue reading

US30 is trading at 33849, 0.03% up since previous day close. The flat to higher side trading can be seen in U.S markets amid mixed sentiments over Continue reading

WTI Oil is trading at $87.68, 0.14% up since previous day close. A strong upside can be seen in Oil prices amid rising tension between Hamas & Israel which may affect Continue reading

USD/CAD, XAUUSD (Gold) & CHNIND

USD/CAD is trading at 1.36821, 0.11% down since previous day close. The Canadian Dollar (CAD) weakened against the USD on Friday as U.S inflation rate rose by 0.4% agains Continue reading

CHNIND is trading at 6139.3, 0.08% down since previous close. The Asian shares subdued following a downside in U.S markets as U.S issued a rise in CPI rate by 0.4% higher Continue reading

Gold is trading at $1874.44, 0.02% up since previous close. The gold seems to be trading flat to higher side against the mixed USD post result of U.S CPI data which showe Continue reading

USD/JPY, WTI Oil & US100

USD/JPY is trading at 149.154, 0.02% up since previous day close. The YEN seems to be trading sideways amid mixed USD on an account of uncertain Fed monetary outlook in i Continue reading

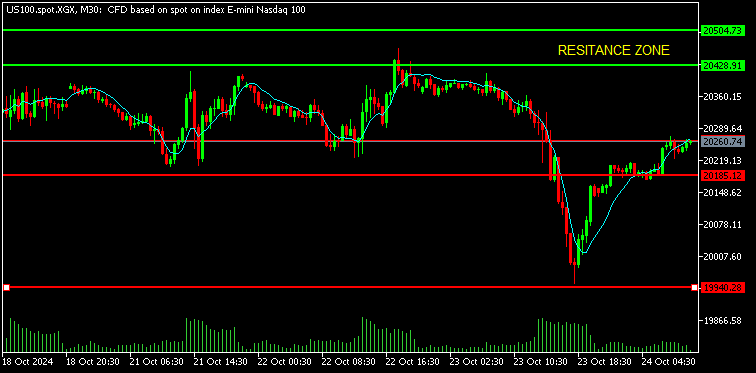

US100 is trading at 15424, 0.29% up since previous day close. The U.S markets gained as optimism looms over dovish rate hike stance in upcoming Fed’s meet as hinted by Continue reading

WTI Oil is trading at $83.16, 0.24% down since previous day close. The Oil prices retreated on Thursday post release of U.S API report which showed a heavy build-up in Oi Continue reading

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)