Request A Call Back

Register Real Account

Register Demo Account

Soft USD May Turn Up Bullish For Agri-Commodities & Base Metals

By Research Team Thursday, Feb 2, 2023

- 10.42amW1

- High184.05

- Low175.5

- Close176.75

Coffee traded at 176.80, 0.05% down since previous day close. The correction can be seen in Coffee prices after rallying up to 3-month highs of $180 levels in the previous session. However, the bullish trend may remain intact in Coffee amid multiple global cues. The Coffee is expected to open on higher note on Thursday as USD softened post FOMC expected move of hiking 25bps interest rate; for USD & Brazilian Real (BRL) currency holds inverse trading correlation. Also, an upside can be seen in Coffee prices as Chinese Lunar New Year holidays ends, reviving the trading liquidity in major agri-commodities. As seen in the chart, the Coffee has entered into bullish zone & hence, buying on each corrective dip may be recommended on short term basis.

Read More… Read LessCommodities

COFFEE

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 195.866 |

| R2 | 187.32 |

| R1 | 182.03 |

| Turnaround | 178.77` |

| S1 | 173.48 |

| S2 | 170.22 |

| S3 | 161.66 |

By Research Team Thursday, Feb 2, 2023

- 11.05amD1

- High1529.37

- Low1523.33

- Close1529.34

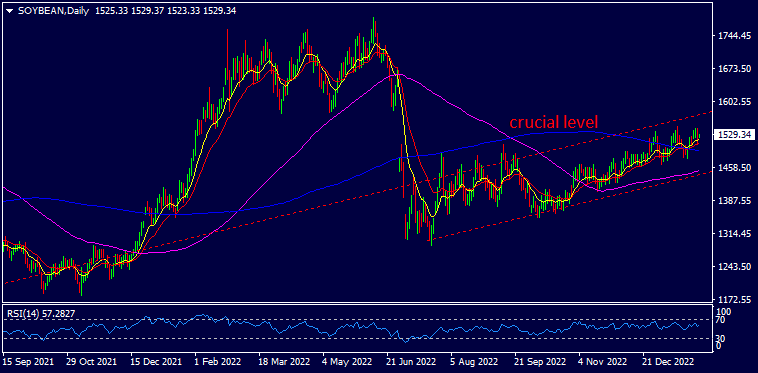

Soybean is trading at $1528.98, 0.03% up since previous close. The range bound trading can be seen in Soybean prices; however, the buying pressure is expected to gradually build up in agric-commodities against the soft USD. On Wednesday, the U.S FOMC hiked an interest rate by 25bps as expected but hinted for more hikes if required in future. This may turn up bullish for commodities. Also, the weekly USDA report showed a heavy fall in Soybean exports & supplies level & the change in climatic conditions resulting into droughts in Argentina pushed up the prices since Argentina is a major producer of beans. Buying on lower levels may be recommended for the day in Soybean.

Read More… Read LessCommodities

SOYBEAN

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1587.23 |

| R2 | 1556.05 |

| R1 | 1537.96 |

| Turnaround | 1524.27 |

| S1 | 1506.18 |

| S2 | 1492.49 |

| S3 | 1460.7 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)