Request A Call Back

Register Real Account

Register Demo Account

GBP/USD Rebounds, US100 Steady on Tesla Earnings, Gold Rises on Geopolitical Tensions.

By Research Team Thursday, Oct 24, 2024

- 14:30D1

- High1.29941

- Low1.29066

- Close1.29149

GBP/USD is trading at 1.29678, 0.4% up since previous day close. The Pound Sterling (GBP) has rebounded against the US Dollar (USD) after a two-month low. The outlook for the US Dollar remains firm due to a slight decline in market expectations for the Federal Reserve to reduce interest rates in remaining policy meetings this year. The US presidential election outcome has improved the Dollar’s appeal as a safe-haven.

Read More… Read LessDaily Outlook

GBPUSD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.30100 |

| R2 | 1.3035 |

| R1 | 1.2985 |

| Turnaround | 1.29332 |

| S1 | 1.2904 |

| S2 | 1.2856 |

| S3 | 1.2727 |

By Research Team Thursday, Oct 24, 2024

- 15:00D1

- High20409

- Low19947

- Close20161

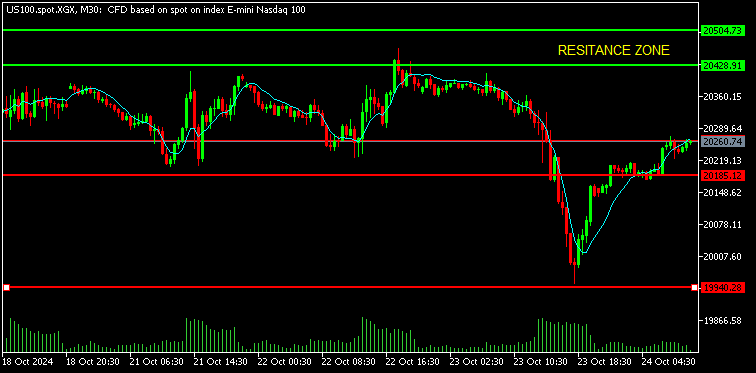

US100 is trading at 20260, 0.01% up since previous day close. Tesla’s earnings beat boosted its shares by 12%, while bond yields weakened on soft business surveys overseas. There’s concern that pre-election trades on Trump’s White House win may be premature. There’s no clear indication on how the close contest will break, and Treasury yields have fallen below 4.2%. The Bank of Canada and Bank of Japan have cut policy rates, and Tesla’s earnings beat likely wipes out year-to-date losses when trading resumes today.

Read More… Read LessDaily Outlook

US100

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 20504 |

| R2 | 20506 |

| R1 | 20428 |

| Turnaround | 20300 |

| S1 | 20185 |

| S2 | 20076 |

| S3 | 19940 |

By Research Team Thursday, Oct 24, 2024

- 15:30D1

- High2758

- Low2708

- Close2721

GOLD is trading at 2738, 0.84% up since previous day close. Gold prices are expected to rise in 2025 despite being overpriced, according to Deveya Gaglani, a commodities research analyst at Axis Securities. Spot gold has seen its best year-to-date performance since 2007, indicating increased investor optimism. Geopolitical tensions, strong demand from China, and a Fed rate cut are expected to further support gold prices, with spot gold currently 0.8% higher at $2,736.74.

Read More… Read LessDaily Outlook

GOLD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 2758 |

| R2 | 2752 |

| R1 | 2748 |

| Turnaround | 2730 |

| S1 | 2725 |

| S2 | 2715 |

| S3 | 2709 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)