Request A Call Back

Register Real Account

Register Demo Account

GBP/USD, SILVER and US30

By Research Team Tuesday, Sep 13, 2022

- 11.40amD1

- High1.17057

- Low1.16801

- Close1.16879

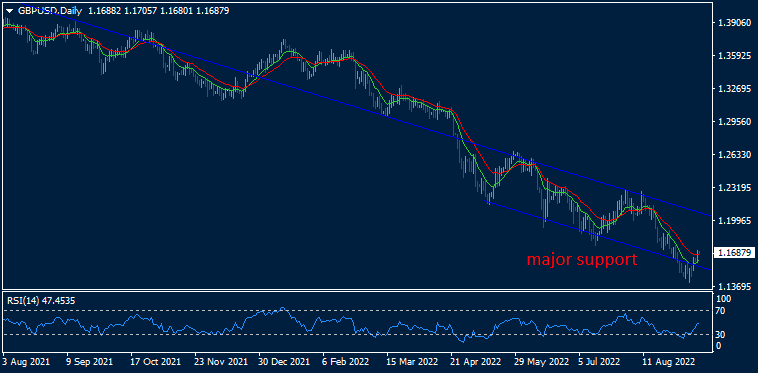

GBP/USD is trading at 1.16938, 0.14% up since previous day close. The Pound gained momentum against the steady USD ahead of the release of U.S CPI data; due today. Earlier, the pair slid down as traders expects a 75bps rate hike stance in the forthcoming Fed meeting. On Monday, the GDP rate grew by just 0.2% against the previous fall of 0.6% & the Production figures, also, showed the poor result. However, the market will be eyeing an outcome of Average Earnings Index & Claimant Count Change data which is to be issued today. As seen in chart, the pair reversed up from lower trend-line of channel pattern; how-so-ever, it is trading near MA (10) & MA (20). This indicates the chances of make or break situation on short to medium term basis.

Read More… Read LessDaily Outlook

GBP/USD

| Intra Day | |

| Near Day |  |

Technical Levels

| R3 | 1.11959 |

| R2 | 1.11671 |

| R1 | 1.11505 |

| Turnaround | 1.11383 |

| S1 | 1.11217 |

| S2 | 1.11095 |

| S3 | 1.10807 |

By Research Team Tuesday, Sep 13, 2022

- 10.35amW1

- High19.866

- Low19.52500

- Close19.649

Silver is trading at $19.677, 0.26% up since previous day close. The precious metals moved on higher side against the soft USD as traders waits for the result of U.S CPI data which is to be issued today. Also, this will contribute in monetary decision making in the next Fed meeting; wherein a rate hike of 75bps is being expected. Besides this, the recovery in Chinese economic & industrial situation post PBoC’s announcement of aiding stimulus package led further buying bias in Silver prices. The result of Federal Budget Balance will remain in focus for the day. As seen in the chart, the Silver almost crossed MA (10) with heavy trading volume; surpassing the MA (20) may emerge further buying pressure.

Read More… Read LessDaily Outlook

SILVER

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 21.90030 |

| R2 | 20.73200 |

| R1 | 20.28600 |

| Turnaround | 19.56300 |

| S1 | 19.11800 |

| S2 | 18.39300 |

| S3 | 17.22800 |

By Research Team Tuesday, Sep 13, 2022

- 11.57amW1

- High32431

- Low32371

- Close32394

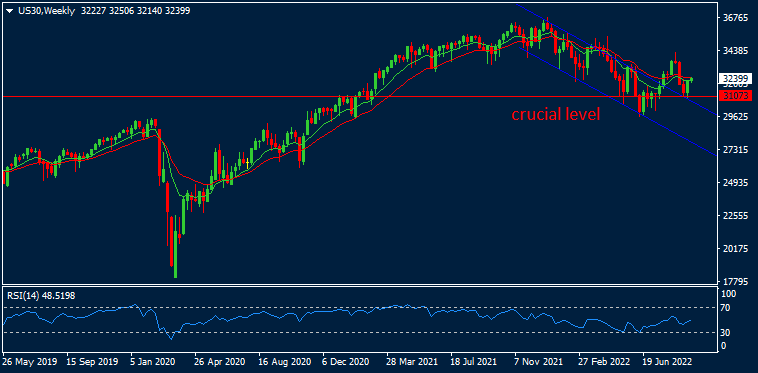

US30 is trading at 32411.8, 0.18% up since previous day close. The U.S markets recovered on Monday against the soft USD as market waits for the result of U.S CPI data which is to be issued today. Besides this, an aggressive rate hike chances by 75bps in upcoming Fed meeting seems to be discounted-in the equity markets; now emerging the positive sentiments. Last week, the shares recovered post ECB meeting wherein an interest rate was hiked by 75 bps as expected. The result of U.S CPI & Federal Budget Balance data will be closely monitored today. As seen in the chart, the US30 crossed over the upper trend-line of channel pattern & is on the verge of crossing over Moving Averages. Buying on corrective dips may be recommended for the day in US30.

Read More… Read LessDaily Outlook

US30

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 33084.00000 |

| R2 | 32718.00000 |

| R1 | 32563.00000 |

| Turnaround | 32352.00000 |

| S1 | 32197.00000 |

| S2 | 31986.00000 |

| S3 | 31620.00000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)