Request A Call Back

Register Real Account

Register Demo Account

Range Bound Indices Ahead of U.S Fed Minutes Release While Gold Inches Up

By Research Team Tuesday, Nov 21, 2023

- 9.33amw1

- High1.37297

- Low1.37048

- Close1.37114

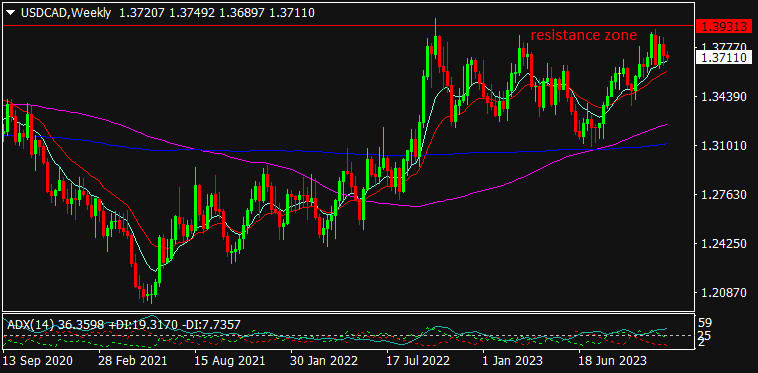

USD/CAD is trading at 1.37111, 0.13% up since previous day close. The CAD strengthened against the soft USD ahead of the release of U.S Fed Minutes due today late evening. The rising hopes over a rate cut in the year 2024 led the selling pressure in USD & U.S bond yields while this cushioned other basket of currencies. The Chinese stimulus aid further boosted the global sentiments. The Canada is to issue its inflation data today which will be closely monitored. As seen in the chart, the pair reversed down after testing the major resistance of previous highs & is currently hovering near MA (10) & MA (20). If breached the level, a strong breakdown can be expected & hence, slight buying may be noticed in CAD against the USD.

Read More… Read LessDaily Outlook

USD/CAD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.38408 |

| R2 | 1.37813 |

| R1 | 1.37538 |

| Turnaround | 1.37218 |

| S1 | 1.36943 |

| S2 | 1.36623 |

| S3 | 1.36028 |

By Research Team Tuesday, Nov 21, 2023

- 9.52amd1

- High16122

- Low16092

- Close16107

US100 is trading at 16113.3, 0.12% up since previous close. The U.S markets moved slightly on higher side after U.S major tech company, the Microsoft, hired AI executives which widely boosted up the global sentiments. Also, the traders will be eyeing the outcome of U.S Fed Minutes which is to be issued today. Besides this, the Chinese PBoC steps of leaving Prime Loan Rate steady & injecting the stimulus aid into financial system made the global equity markets to trade on higher side. The result of Existing Home Sales data will be closely monitored for the day. As seen in the chart, the index is hovering near the major resistance of previous highs & hence, a breakout can be seen if breaches the level otherwise a reversal can be seen if sustained.

Read More… Read LessDaily Outlook

US100

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 16573.00000 |

| R2 | 16295.00000 |

| R1 | 16197.00000 |

| Turnaround | 16017.00000 |

| S1 | 15919.00000 |

| S2 | 15739.00000 |

| S3 | 15461.00000 |

By Research Team Tuesday, Nov 21, 2023

- 10.08amd1

- High77.79

- Low77.3

- Close77.52

WTI Oil is trading at $77.48, 0.06% down since previous day close. The Oil prices retreated to some extent on Tuesday ahead of the release of U.S American Petroleum Institute (API) report which will show the changes in Oil stocks level as compared to last week. The focus will be on OPEC+ meeting which is to be held on November 26th, at Vienna to show the changes in Oil output levels. The escalating tension between Hamas & Israel & forthcoming event of U.S Fed Minutes release may remain vital for Oil prices. The cautious trading may be recommended for the day in WTI Oil since the commodity is trading near MA (10) & MA (20) & MA (100). An either side breakout can be seen for the day in WTI Oil.

Read More… Read LessDaily Outlook

OIL

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 82.41000 |

| R2 | 79.80000 |

| R1 | 78.72000 |

| Turnaround | 77.31000 |

| S1 | 76.17000 |

| S2 | 74.70000 |

| S3 | 72.21000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)