Request A Call Back

Register Real Account

Register Demo Account

Mixed Global Stance Restricted Upside in Equities & Gold

By Research Team Monday, Mar 27, 2023

- 10.02amD1

- High0.9199

- Low0.91795

- Close0.91868

USD/CHF is trading at 0.91824, 0.04% down since previous day close. The sideways momentum can be seen in Swiss Franc in early trade on Monday as fear still looms over banking crisis in U.S & European regions. Last week, the US Dollar softened after Fed hiked an expected 25bps interest rate leading to 5.00% from 4.75% & also, hinted for more rate hikes if required in near future which led into buying pressure in other major currencies. The Swiss National Bank (SNB) hiked its LIBOR rate by 50 bps from 1.00% to 1.50% which turned out to be positive for USD/CHF. As seen in chart, the pair is trading near lower trend-line of channel pattern; indicating the chances of breakdown. Buying in CHF may be recommended against USD.

Read More… Read LessDaily Outlook

USD/CHF

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 0.93136 |

| R2 | 0.92516 |

| R1 | 0.92244 |

| Turnaround | 0.91896 |

| S1 | 0.91624 |

| S2 | 0.91276 |

| S3 | 0.90656 |

By Research Team Monday, Mar 27, 2023

- 10.21amD1

- High7452.2

- Low7436.5

- Close7448.5

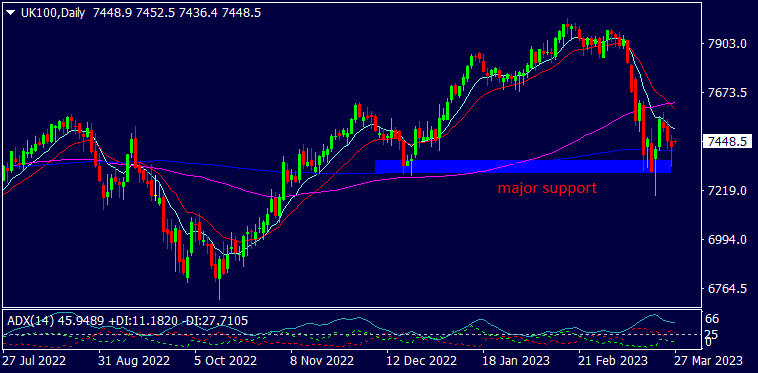

UK100 is trading at 7448, 0.03% down since previous day close. The flat to downside momentum can be seen in global markets as traders & investors remains cautious over banking & financial crisis in U.S & Europe. On data front, the Flash Manufacturing PMI fell to 48.0 from 49.3 & the Flash Services PMI dropped to 52.8 against the expectation 53.1. These slightly weighs down the index UK100. Last week, the mixed stance from U.S Treasury Secretary Janet Yellen over taking measures towards banking crisis & deposits led traders more susceptible over global growth dragged down the equities. As seen in the chart, the index successfully is hovering near short-term MA (200) & previous lows which indicates the buying pressure on short term basis,

Read More… Read LessDaily Outlook

UK100

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 7697.00000 |

| R2 | 7553.00000 |

| R1 | 7489.00000 |

| Turnaround | 7409.00000 |

| S1 | 7345.00000 |

| S2 | 7265.00000 |

| S3 | 7121.00000 |

By Research Team Monday, Mar 27, 2023

- 10.40amD1

- High1978.79

- Low1971.99

- Close1972.74

Gold is trading at $1973.14, 0.13% down since previous close. The corrective phase can be seen in precious metals after rallying to $2000 mark last week. Ongoing ruction in U.S banking sector made the safe haven instruments more expensive. Last week, the steady USD as U.S Secretary Janet Yellen showed mixed statements for measures over deposits in Signature & SVB banks. Earlier, the USD slid down to seven-month lows as Fed hiked an interest rate by 25bps leading to 5.00% from 4.75%; though hinting for more rate hikes in near future led buying pressure in metals. The Gold may test the MA (10) on correction & hence, slight trading may be recommended for the day.

Read More… Read LessDaily Outlook

XAUUSD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 2040.77000 |

| R2 | 2012.89000 |

| R1 | 1994.89000 |

| Turnaround | 1985.01000 |

| S1 | 1967.01000 |

| S2 | 1957.13000 |

| S3 | 1929.25000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)