Request A Call Back

Register Real Account

Register Demo Account

BoE & BoJ Left Interest Rate Steady, Indices Trades Mixed While Oil Prices Surges Up

By Research Team Friday, Sep 22, 2023

- 9.46amd1

- High148.256

- Low147.502

- Close148.015

USD/JPY is trading at 148.103, 0.12% down since previous day close. The YEN weakened post Bank of Japan (BoJ) meeting wherein an interest rate was held steady at -0.10% while the traders would be expecting an end to negative interest rate cycle. On data front, the Japan’s Flash Manufacturing PMI fell to 48.6 from 49.6 in previous month which further dragged down the USD/JPY. Globally, the strong USD after U.S Fed Powell hinted for one more rate hike in this year; although keeping an interest rate steady at 5.50% in its recent meeting depreciated the major currencies. As seen in the chart, the pair is consistently trading above the short-term MA (10) & MA (20) & hence, further selling in YEN may be expected against the USD on daily basis.

Read More… Read LessDaily Outlook

USD/JPY

| Intra Day | |

| Near Day |  |

Technical Levels

| R3 | 150.08400 |

| R2 | 148.94000 |

| R1 | 148.29000 |

| Turnaround | 147.80800 |

| S1 | 147.15900 |

| S2 | 146.67000 |

| S3 | 145.53200 |

By Research Team Friday, Sep 22, 2023

- 10.08amd1

- High7718

- Low7683

- Close7713

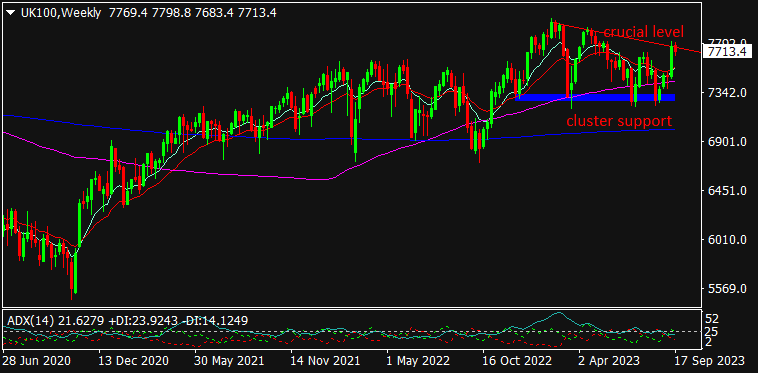

UK100 is trading at 7714.3, 0.03% down since previous close. The U.K index seems to be trading range bound after Bank of England (BoE) left an interest rate steady at 5.25% against the expected hike of 25 bps. On global front, the hawkish U.S Fed stance over raising an interest rate once in this year & two more hikes in next year; although keeping an interest rate steady at 5.50% range in its latest meeting led the selling pressure in equity markets. The result of U.K Flash Services & Manufacturing PMI data will remain in to focus for the day. As seen in the chart, the index is strongly reversed up from cluster support in last week; how-so-ever, it is hovering near bearish trend-line & hence, the cautious trading may be recommended for the day.

Read More… Read LessDaily Outlook

UK100

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 7942.00000 |

| R2 | 7834.00000 |

| R1 | 7764.00000 |

| Turnaround | 7726.00000 |

| S1 | 7656.00000 |

| S2 | 7618.00000 |

| S3 | 7510.00000 |

By Research Team Friday, Sep 22, 2023

- 10.25amw1

- High90.4

- Low89.55

- Close90.31

WTI Oil is trading at $90.30, 0.21% up since previous day close. The Oil prices rallied on Friday after Russia bans its fuel exports which affects the supplies of Oil throughout the world since Russia is one of the major suppliers of Crude Oil. This outweighs the negative effect emerging out of U.S Fed’s hawkish stance in near future; though keeping an interest rate steady at 5.50% range. The supply cuts from Saudi Arabia & Russia will remain significant for the prices in long-run. The result of U.S Baker Hughes report will remain in focus for the day. As seen in the chart, the Oil seems to be trading firmly near major resistance of previous highs & hence, a breakout can be seen if breaches the level.

Read More… Read LessDaily Outlook

WTI Oil

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 94.92000 |

| R2 | 92.30000 |

| R1 | 91.01000 |

| Turnaround | 89.68000 |

| S1 | 88.39000 |

| S2 | 87.06000 |

| S3 | 84.44000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)